The stamp duty holiday came into immediate effect on 8th July 2020 and is set to end on 31st March 2021. The changes to stamp duty were announced by the UK Government on 8th July 2020.

The Chancellor Rishi Sunak announced the stamp duty holiday in his summer statement as part of the economic response to the Covid-19 pandemic. The changes to stamp duty are designed to support the housing sector through the crisis.

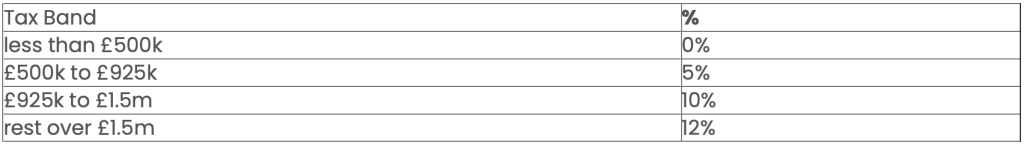

The initial threshold for anyone buying a home has increased from £125k to £500k. This means that the majority of house purchases in England and Northern Ireland will not be liable for stamp duty as long as purchase are completed before 31st March 2021.

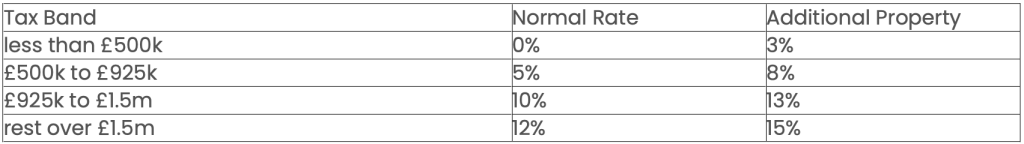

Additional property transactions will also benefit from the higher initial threshold with only the lower surcharge of 3% being applied to buy to let and second home purchases up to £500k.

The stamp duty holiday applies to house purchases in England and Northern Ireland, a separate LBTT holiday is operating in Scotland and a LTT holiday is active in Wales.

The stamp duty holiday is due to end on 31st March 2021. This means in order to benefit from the stamp duty holiday, house purchases must complete before 31st March 2021.

From April 2021 onwards the stamp duty rates and thresholds are due to revert back to previous levels. Scottish LBTT and Welsh LTT holidays are also due to end on 31st March 2021.

The freehold residential stamp duty rates in England and Northern Ireland are shown in the table below and are valid until 31st March 2021. The rates reflect the higher initial threshold following the introduction of the stamp duty holiday.

An additional property purchased for less than £40k will attract 0% tax. For purchases from £40k to £500k the SDLT rate will be 3% on full purchase price.

For First Time Buyers the stamp duty calculators below show SDLT calculations before and 31st March 2021.

Start your real estate journey today with Lex Home. Lex Home is a company operating in the UK real estate market, especially in London.

Copyright 2023 © Lex Home. All rights reserved. | MEZ BILISIM